Venture Returns in Digital Health

A metrics-driven assessment of digital health exits over the past 10 years

I started my career in 2013 when it felt like digital health was in its infancy. Everyone I met was optimistic about the impact digital health companies would have on patients and the commensurate returns they would generate for investors.

While the sector has matured over the past 10 years and startups benefit from meaningfully more funding today, the narrative is that digital health has not delivered on return expectations. As an operator and angel investor in digital health startups, I decided to take an objective look at exits in digital health over the past 10 years to see if those views hold water.

A few key takeaways from my analysis:

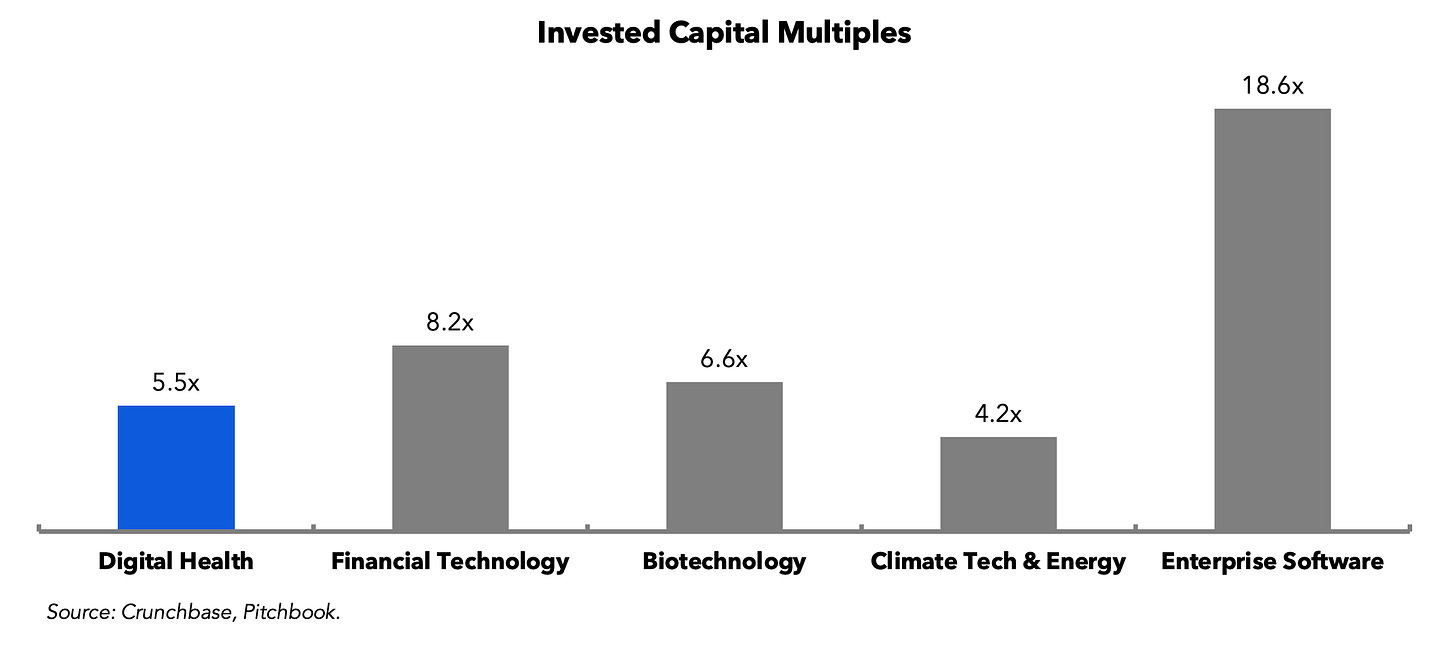

Digital health startups have been moderately less capital efficient than other verticals, but achieve >$1B exit more quickly. By measure of invested capital multiples (total market capitalization generated divided by total equity invested capital among $1B+ exits), digital health businesses are moderately less capital efficient than other verticals including climate & energy, financial technology, and biotechnology (5.4x invested capital multiple for digital health vs. 7.0x average for other verticals) but achieved a $1B+ exit more quickly than other verticals (9.9 years to $1B+ for digital health vs. 11.4 years for other verticals). However, enterprise software businesses are meaningfully more capital efficient, boasting an invested capital multiple of 18.6x, >250% higher than that of digital health. Additionally, they achieve a $1B+ exit in just 9 years compared to 9.9 years for $1B+ digital health exits.

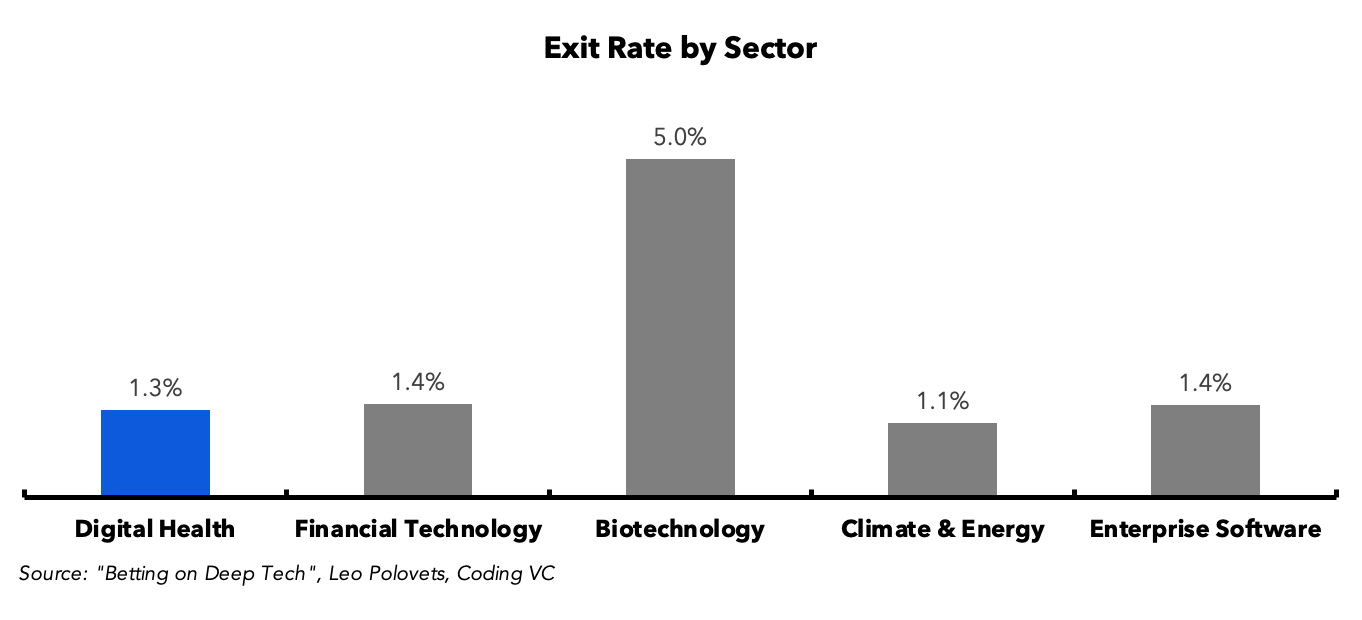

Digital health startups achieve a successful exit at the same rate as other verticals as well as enterprise software broadly. By measure of exit rate over the past 10 years (total # of $250M+ exits divided by total number of startups receiving $1M+ in venture funding), digital health startups are just as likely to experience a successful exit as other verticals and enterprise software (exit rate among digital health startups was 1.3% vs. 1.4% for financial technology, 1.1% for climate & energy, and 1.4% for enterprise software).

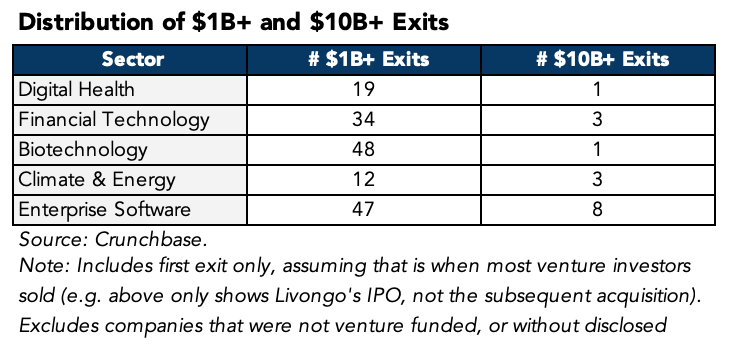

Digital health may be less likely to achieve large “grand slam” exits, though possibly due to lower overall company generation. The industry does not consistently produce the mega-large outcomes ($10B+) we have seen in the technology industry broadly; however, startup formation in digital health has been considerably lower than other verticals so entrepreneurs have had fewer shots on goal.

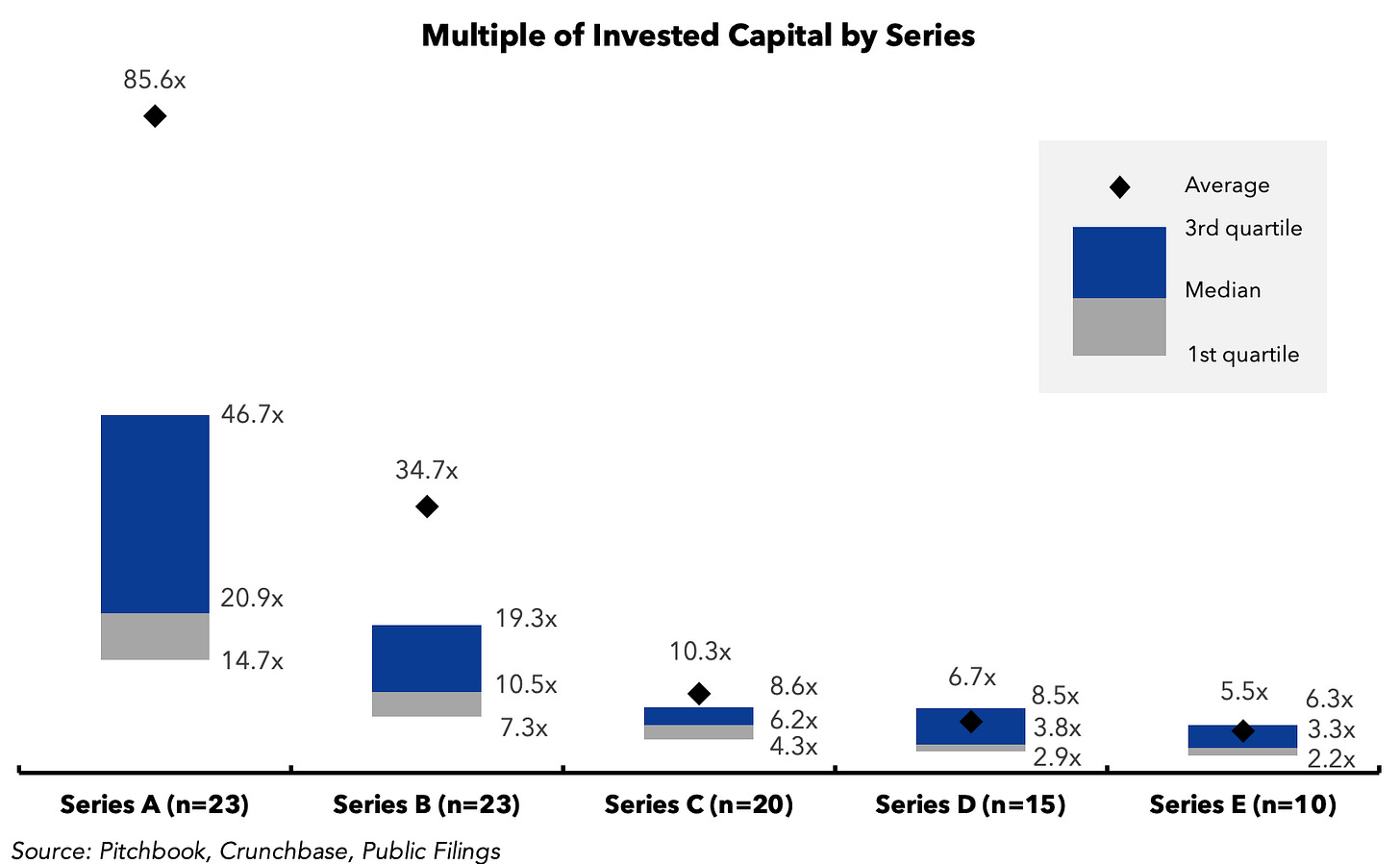

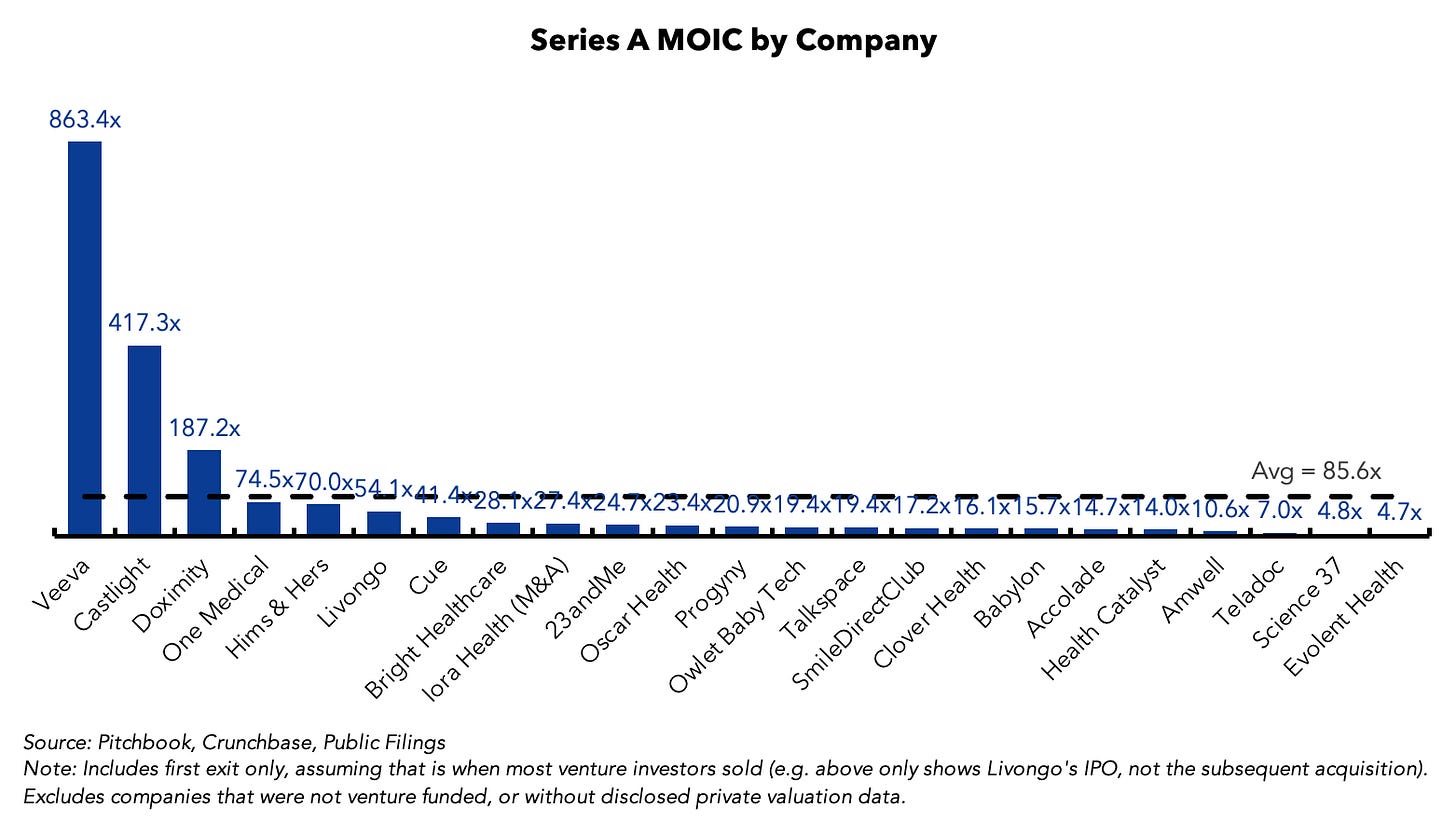

Highest returning digital health startups generated fund-defining outcomes for early investors. Despite the above, those investors fortunate to back the highest returning healthcare startups – Veeva, Castlight, Doximity, One Medical, Hims & Hers, Livongo, and others – have generated tremendous returns. The average multiple of invested capital (MOIC) from $1B+ exits (approximated by comparing exit values to valuation at investment and accounting for dilution from subsequent rounds) exceeded 85x for series A and 34x for series B investors.

Read on to learn more.

Comparing Returns in Digital Health to Other Sectors

To gauge digital health’s performance, we can’t look at metrics in isolation – we need to compare digital health to other sectors venture capitalists invest in to gauge relative performance. As such, I compare digital health to several verticals including:

Financial Technology

Biotechnology

Climate & Energy

Enterprise Software

In an ideal world, we would compare metrics like TVPI, DPI, and IRR across these sectors. In the absence of that data, I compare metrics that proxy returns such as:

Invested capital multiples

Time to exit

Success & loss ratios

Exit values

1. Invested Capital Multiples

Invested capital multiples compare the exit value of the business when they were acquired, merged, or went public to the amount of capital they had raised privately to achieve that milestone. Companies that use less capital to produce the same outcome, all else equal, will produce better returns for investors. Crunchbase compiled data on $1 billion+ exits from 2020-2023 which I have used to calculate multiples by sector.

One common gripe about healthcare is how capital-intensive it is. Yet, by measure of invested capital multiples, digital health is only moderately less capital efficient than financial technology and biotechnology and more capital efficient than climate & energy. Enterprise software businesses are meaningfully more capital efficient with an invested capital multiple of 18.6x, 250% greater than digital health’s multiple.

2. Time to Exit

We all know that money sooner is better than money later. A startup that is long in the tooth can tank an investor’s internal rate of return (IRR). Digital health businesses took nearly 1 year longer to achieve a $1 billion exit than enterprise software businesses, based on data from Crunchbase, but exited 1.5 years more quickly than financial technology businesses and 5.5 years quicker than climate & energy businesses. Biotechnology startups exited in 7.5 years, likely because they commonly go public more as a means of financing than an ultimate liquidity event.

3. Success Ratios

Success ratios give us a good sense of how likely it is that a venture capitalist will experience a positive outcome in their portfolio. All else equal, 20% of your portfolio achieving a successful exit is better than 10%.

Leo Polovets of Susa Ventures put together a nice post detailing outcomes in the deep tech space and calculated exit rates across several sectors leveraging Pitchbook data. Comparing the total number of companies who received $1M+ funding to those who achieved a $250M exit, Leo proxied exit rate by sector.

By measure of exit rate, digital health is no better or worse than financial technology or climate & energy, and has nearly the same success ratio as enterprise software. As stated above biotechnology businesses may have a higher success ratio because they often go public earlier as a means to finance their businesses to a larger exit.

4. Size of Outcomes

While capital efficiency, time to exit, and success rate are important metrics to consider, venture capital is ultimately a hits-based business – a very small fraction of companies produce the lionshare of returns. Benchmark famously turned a $9 million investment in Uber into ~$7 billion as of the IPO, ~800x their investment and ~16x the $425M fund they had recently raised. Big outcomes make all of the difference.

Between 2020 and 2023, digital health has produced fewer large outcomes than other verticals. With that said, digital health may be producing fewer large outcomes simply because company generation is lower – according to the Pitchbook data, ~1,100 digital health businesses received $1M+ in funding over the past 10 years vs ~3,300 in financial technology, ~2,800 in biotechnology, and ~7,800 in enterprise software.

A Closer Look at Returns in Digital Health

The metrics described above paint a picture of how investable digital health is relative to other sectors, but they don’t tell the whole story. Returns depend on ownership at exit, entry valuation, and investment duration.

Based on $1 billion+, venture-backed digital health exits since 2013, I attempt to estimate MOIC by the series an investor initially invested in by comparing exit valuation (for public offerings, I used market capitalization at lock-up) relative to post-money valuation at the time of investment. I estimate dilution based on subsequent investment relative to post-money valuation.

Returns don’t disappoint. Investors returned 85.6x their series A investment and 34.7x series B investment on average. With an average series A investment of $17M across this cohort and assuming the lead took 75% of the round, an MOIC of 85.6x implies an absolute return of >$1B, not accounting for any follow-on investments. Series B investors faired well, returning 34.7x their investment and >$1 billion as well under similar assumptions. When you compare aggregate returns to the fund sizes in the early 2010s when investors backed many of these companies, >$1B is enough to return an early-stage fund multiple times over. Emergence invested in early venture rounds of both Veeva and Doximity from their $200M fund II.

As would be expected, multiples for later-stage investors dropped considerably as companies mature. Had these investors held their investments after lock up, many saw the value of their investments tumble as the market corrected in mid-2021. By comparison, early-stage investors have a much wider margin of safety – they still lock in a substantial return even in the face of a 30%+ market correction.

Nevertheless, digital health exits follow a power law. Averages are substantially higher than even the 3rd quartiles, especially at series A and B. Double-clicking on MOIC by company, we see that very few outcomes skew the average upwards – particularly Veeva, Castlight, and Doximity. Removing those outliers, averages drop considerably.

Where Does This Leave Us?

My conclusion: returns have been better than the media will have us believe. I agree with many of the points Chrissy Farr makes in her blog post from late last year on resetting expectations for healthcare VCs. On one hand, investors in less capital-efficient healthcare startups may need to be more thoughtful about entry valuations and ownership to make the economics work.

However, historical data can only tell us so much. To understand the instability of the sector going forward, we need to question the assumptions of the past. I believe that we are only in the first inning of technology penetrating the healthcare industry. Look no further than the pharmacies exchanging faxes, doctors using pagers, and payers processing claims manually. Entrepreneurs have never been in a better position to build large, impactful digital health businesses with companies operating in a more favorable regulatory environment, building on top of better infrastructure (e.g. Ribbon for provider network data, Turquoise for price transparency data, GetLabs for on-demand labs, Truepill for digital pharmacy, etc.), not to mention the impact generative AI is already having on the sector. Who says we can’t build massively impactful, $10B or even $100B+ digital health companies? Perhaps a topic for a future post…

I have never been more excited about the future of digital health and the potential for entrepreneurs to generate positive impact for patients and other healthcare stakeholders, and outsized returns for investors. Here’s to the next 10 years.

Thanks to Karan Shah and others for reviewing my initial draft of this post.

Thoughts or feedback? I’d love to hear from you! Reach out at tylerjosephwilson1@gmail.com.